📊 Market Sentiment: Bullish Trend with Cautious Watch

The market continues its upward trajectory, indicated by 8 consecutive green days, but now faces a critical juncture just under major resistance. While the bullish trend is dominant, traders should be vigilant for any trend reversals.

🌏 Major Global Catalysts

Tesla's Wage Increase: Impacts on union interest at the Nevada Gigafactory.

North Korea's ICBM Launch: Escalating geopolitical tensions.

Market Reactions: Mixed signals with rising Treasury yields and fluctuating European and Asian markets.

Venezuela-Guyana Territorial Dispute: Agreement to resolve peacefully.

China's Economic Challenges: Deflation risks highlighted by falling pork prices.

Crypto Political Influence: Super PAC's significant funding for the 2024 elections.

Russia-Ukraine Conflict: New EU sanctions amidst Putin's re-election plans.

📷 Snapshot

Daily

Daily Data Sentiment Analysis:

EMA 9, 21, 55: Indicating a bullish sentiment with closing prices comfortably above these EMAs.

Overall Sentiment: Bullish.

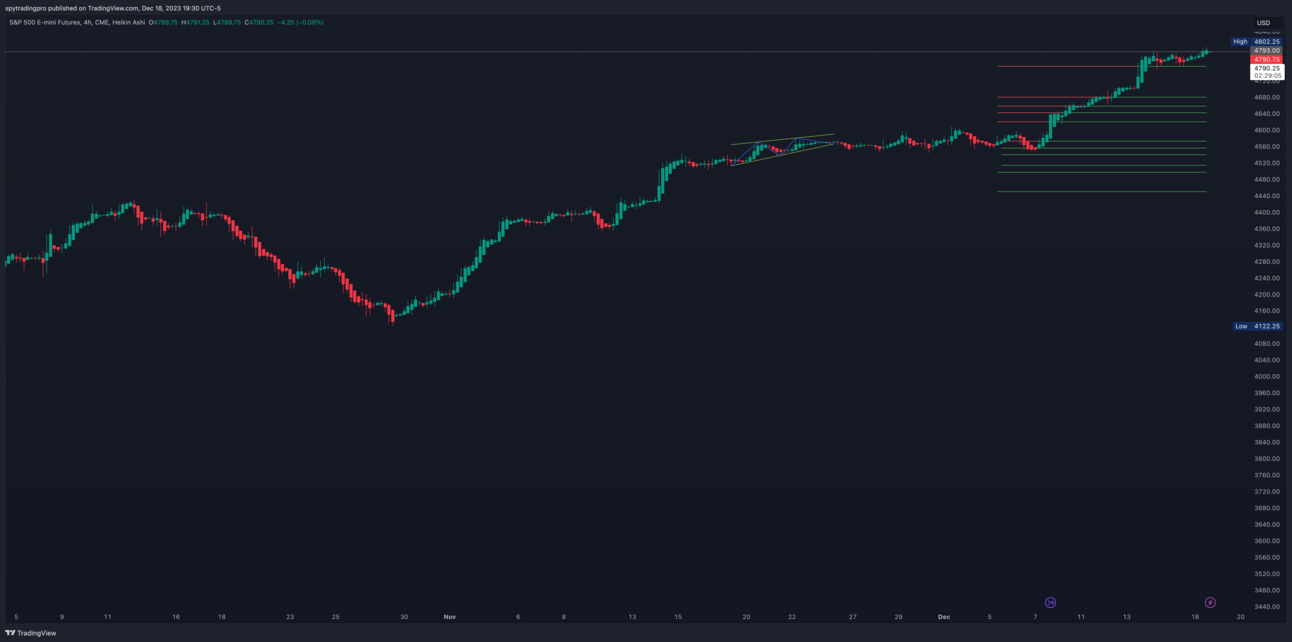

4-Hour

4-Hour Data Sentiment Analysis:

EMA 9, 21, 55: Also showing a bullish trend.

Overall Sentiment: Bullish.

📉 Support Levels

Major: 4788-90, 4781, 4772, 4766, 4763, 4753, 4744, 4730-34, 4726, 4719, 4708, 4698-4700, 4692, 4684, 4673, 4663-66, 4654, 4648, 4634, 4630, 4618-20.

Minor: 4764, 4724-26, 4717, 4700, 4690, 4684, 4678, 4674, 4670.

📈 Resistance Levels

Major: 4796, 4806, 4810-12, 4817, 4825-27, 4838, 4848, 4860, 4873, 4883, 4900, 4906, 4910, 4923-25, 4932, 4945, 4953, 4962, 4976, 4990, 5002.

Minor: 4787, 4795, 4816-20, 4826, 4838.

📝 Trading Plan

Bull Case Analysis:

Key Levels: 4781, 4772.

Strategy: Maintain the breakout, targeting 4808-10.

Risks: Be cautious after 8 green days, the trend could shift.

Bear Case Analysis:

Target Short Entry: If 4773 fails, consider shorts with caution.

Profit Targets: Watch for potential dips towards 4708.

Strategy: Discipline in profit-taking is key, watch for market traps.

Tomorrow’s Outlook:

Discipline and Strategy: Monitor 4781 and 4773 supports closely.

The market remains bullish, but a shift is possible at any moment. Monitor support and resistance levels diligently and adjust strategies as needed.

Disclosure: This is not financial advice and is for informational purposes only. Please consult a professional financial advisor before making any investment decision.