📊 Market Sentiment: Neutral to Bullish

📈 The Markets Overnight

🌏 Asia: Mixed, China down a lot

🌍 Europe: Up a bit

🌎 US Index Futures: Up a bit

🛢 Crude Oil: Up a bit

💵 Dollar: Down slightly

🧐 Yields: Down

🔮 Crypto: Down

🌏 Major Global Catalysts

COP28 deal calls for the tripling of renewable energy capacity by 2030 and the eventual phase-out of fossil fuels.

Today’s quarterly FOMC Economic Projections will contain an updated Dot Plot showing projects for the future of the Fed Funds Rate.

📷 Snapshot

Daily

Daily Data Sentiment Analysis:

EMA 9, 21, 55: Indicating a bullish sentiment with closing prices comfortably above these EMAs.

Overall Sentiment: Bullish.

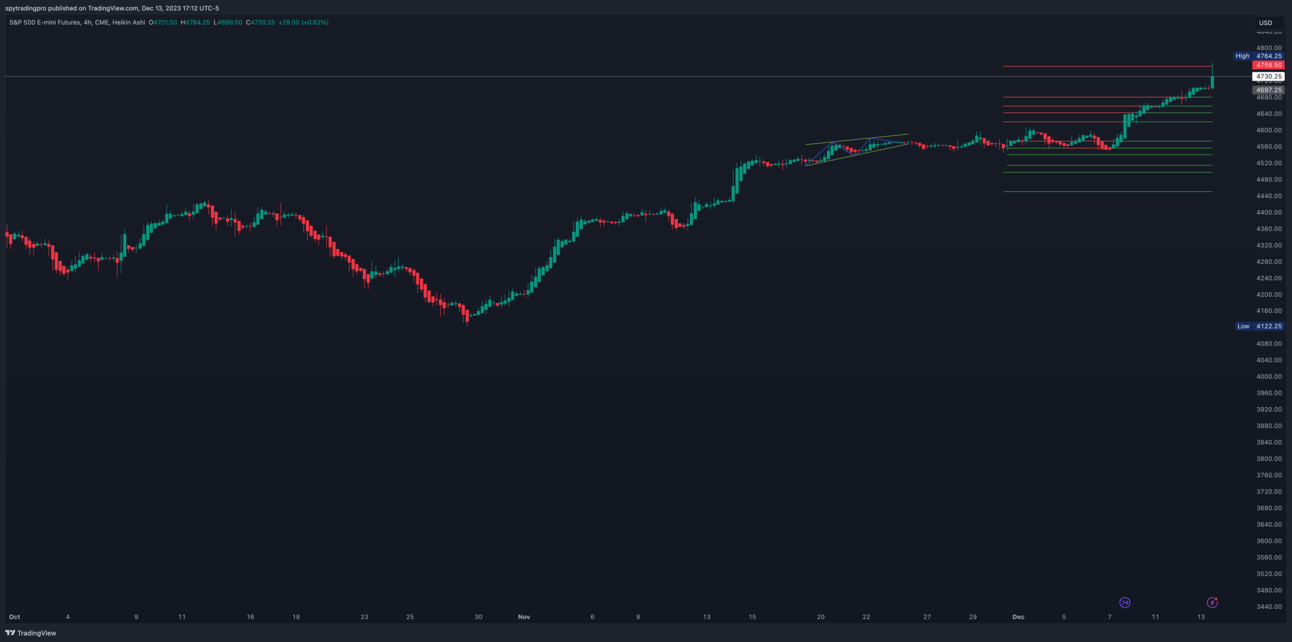

4-Hour

4-Hour Data Sentiment Analysis:

EMA 9, 21, 55: Also showing a bullish trend.

Overall Sentiment: Bullish.

📉 Support Levels

Major: 4758-60, 4734, 4710

Minor: 4743, 4720, 4701

📈 Resistance Levels

Major: 4772, 4780-85, 4808

Minor: 4793, 4812, 4820

📝 Trading Plan

Bullish Scenario: For bullish scenarios, holding above major supports such as 4758-60 and then pushing towards levels like 4772.

Bearish Scenario: For bearish scenarios, a focus on support failures, particularly at 4710-12, would signal a potential trend change and warrant a shift towards short positions.

Disclosure: This is not financial advice and is for informational purposes only. Please consult a professional financial advisor before making any investment decision.