🔄 Recap

In the past month, the S&P 500 Index Futures (ES) has demonstrated an unusual bullish trend, closing four consecutive green weeks. Notably, after breaking out of a downtrend channel on November 14th at 4425, the market has largely maintained an upward trajectory. This breakout signifies a classic technical analysis pattern typically seen in 4-month downtrend reversals.

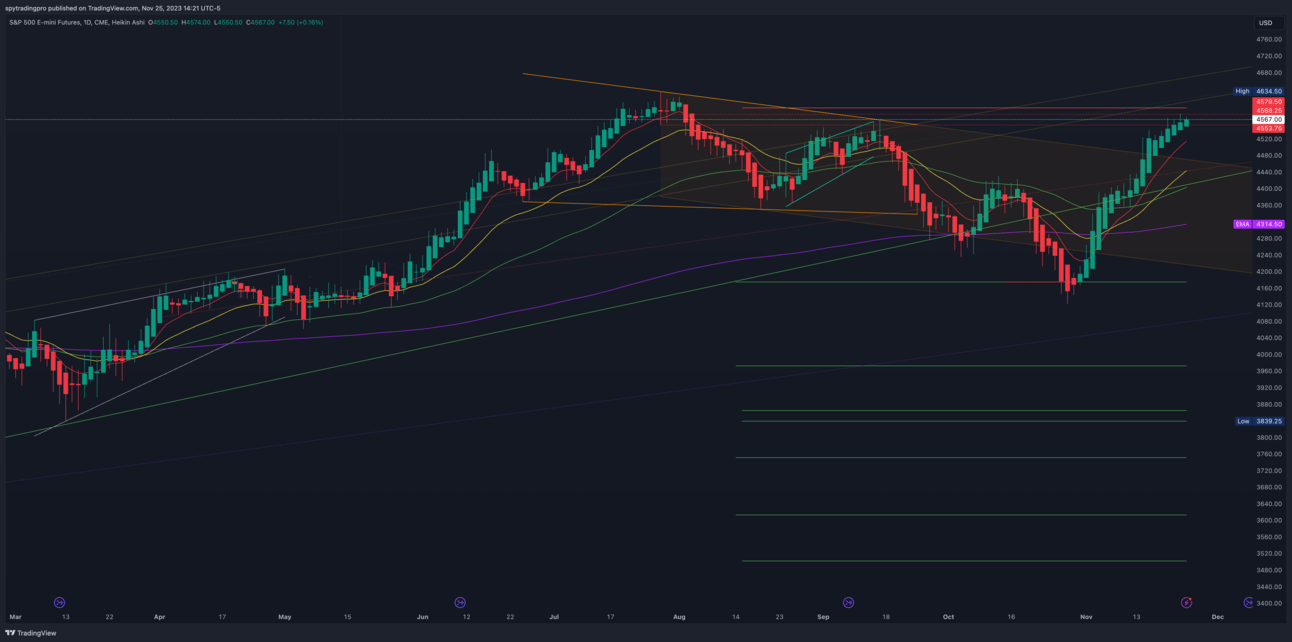

📷 Snapshot

Daily

4-Hour

🔍 Key Structures

4620: Represents a significant trendline connecting the January 2022 COVID bull market high with the August 2022 most recent high.

4577-80: A major resistance level encountered back in late August/early September.

4536-42: A critical horizontal zone that served as key resistance during the summer of 2023.

Other Notable Levels: 4507, 4488-90, 4445, 4436-32, 4408-11, and 4390.

📉 Support Levels

The primary support levels to monitor include 4507, 4488-90, 4445, 4436-32, and the critical 4408-11 zone. These levels have historically played a significant role in the market's movement and will be crucial in determining future trends.

📈 Resistance Levels

Key resistance levels to watch are 4577-80, the upper zone of 4536-42, and the overarching 4620 level. These levels have previously acted as barriers to upward movement and will be critical in assessing the potential for continued bullish momentum.

📝 Trading Plan

Supports to Monitor: 4554, 4549, 4542, 4535, and other major supports down to 4408-11.

Resistances for Potential Reversal: 4565, 4572, 4580, and upwards to 4620.

Bull Case Scenario: Maintaining above 4542-36 on dips to continue the bullish trend.

Bear Case Scenario: A breakdown below 4536-42 could signal a short-term bearish shift.

🔚 Wrap Up

As the market transitions from the Thanksgiving holiday, traders should be prepared for potential volatility and abrupt changes in direction. The emphasis should remain on trading within pre-planned, high-conviction zones and reacting to market shifts rather than predicting them. The approach for Monday hinges on the market's ability to sustain support levels, particularly around 4542-36, to continue the upward trend or signal a bearish reversal if these levels fail.

Disclosure: This is not financial advice and is for informational purposes only. Please consult a professional financial advisor before making any investment decision.