🔄 Recap

Last week's newsletter, titled “SPX Is About To Breakout A Major 4 Month Downtrend,” accurately predicted the market's behavior with the CPI acting as a catalyst for a significant breakout from the core downtrend channel. This led to a substantial uptrend, marking one of the year's pivotal trades.

📈 The Markets Overnight

Asia: Up

Europe: Mixed near unchanged

US Index Futures: Up slightly

Crude Oil: Up strongly

Dollar: Down a bit

Yields: Up a bit

Crypto: Down slightly

🌏 Major Global Catalysts

A significant event in the global market is the victory of the Libertarian candidate in the resource-rich presidential election of Argentina. This could have far-reaching impacts on global trade and market dynamics.Snapshot

Daily

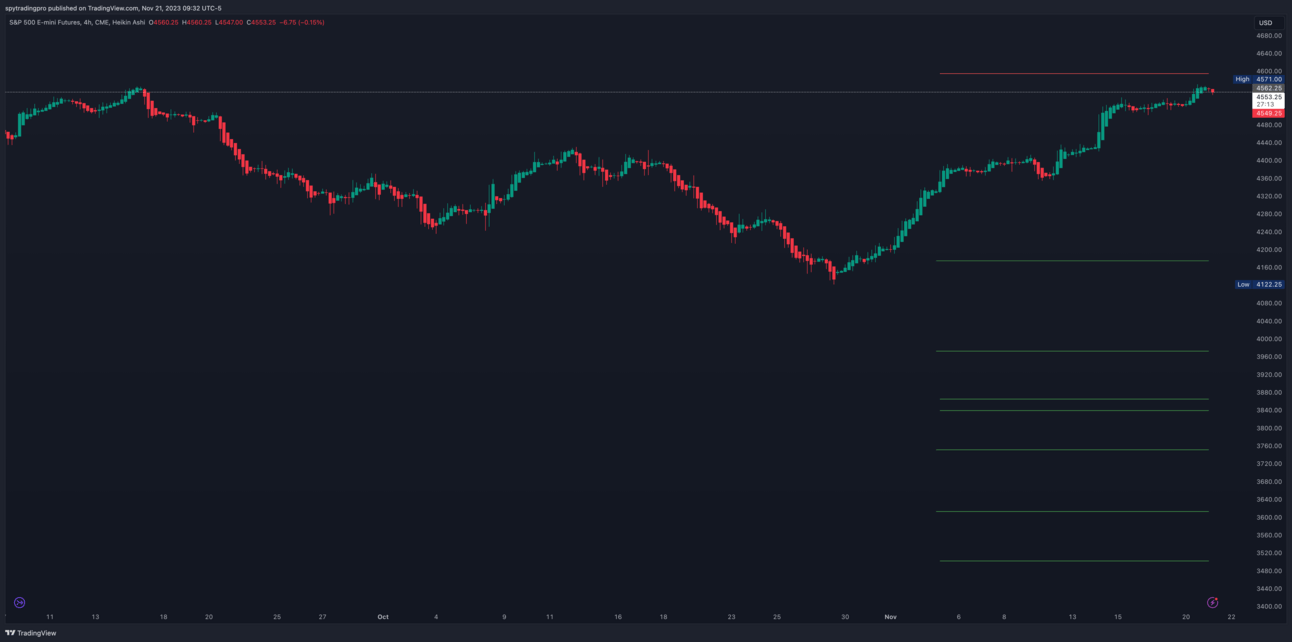

4-Hour

🔍 Key Structures

Upper Resistance: 4623, connecting the January 2022 COVID bull market high with the August 2022 high.

Notable Resistance Zones: 4580, 4556, 4535-43.

Significant Supports: 4485-88, 4445, 4405.

📉 Support Levels

Major: 3502, 3788, 3839

📈 Resistance Levels

Major: 4051, 4180, 4209.

📝 Trading Plan

Short-Term Focus: Monitor 4514-07 as critical support. A break below could signal a short-term bearish trend.

Long-Term Strategy: Maintain focus on the uptrend as long as the market stays above 4405, the core downtrend channel from August.

🔚 Wrap Up

The market is showing signs of consolidation after a significant uptrend. Key levels to watch are 4514-07 for potential downward movements and 4535 for resistance. The market remains in a strong uptrend, and any pullbacks should be considered within this context.

Disclosure: This is not financial advice and is for informational purposes only. Please consult a professional financial advisor before making any investment decision.