Recap

The last week has been tough for the SPX, with 8 of the last 9 days seeing red. After a relentless three-day sell-off, ES managed a 70 point relief rally from Friday's lows. Yesterday, the bulls managed to reverse it and reclaim the 4147-54 level, leading to a green day. The question now is, can bulls manage green day #2, and perhaps more?

The Markets Overnight

🌏 Asia: Mixed

🌍 Europe: Up

🌎 US Index Futures: Up slightly

🛢 Crude Oil: Up a bit

💵 Dollar: Up slightly

🧐 Yields: Down

🔮 Crypto: Down a bit

Major Global Catalysts

US Treasury lowers it’s borrowing estimate for Q4 and Q1.

Snapshot

Daily

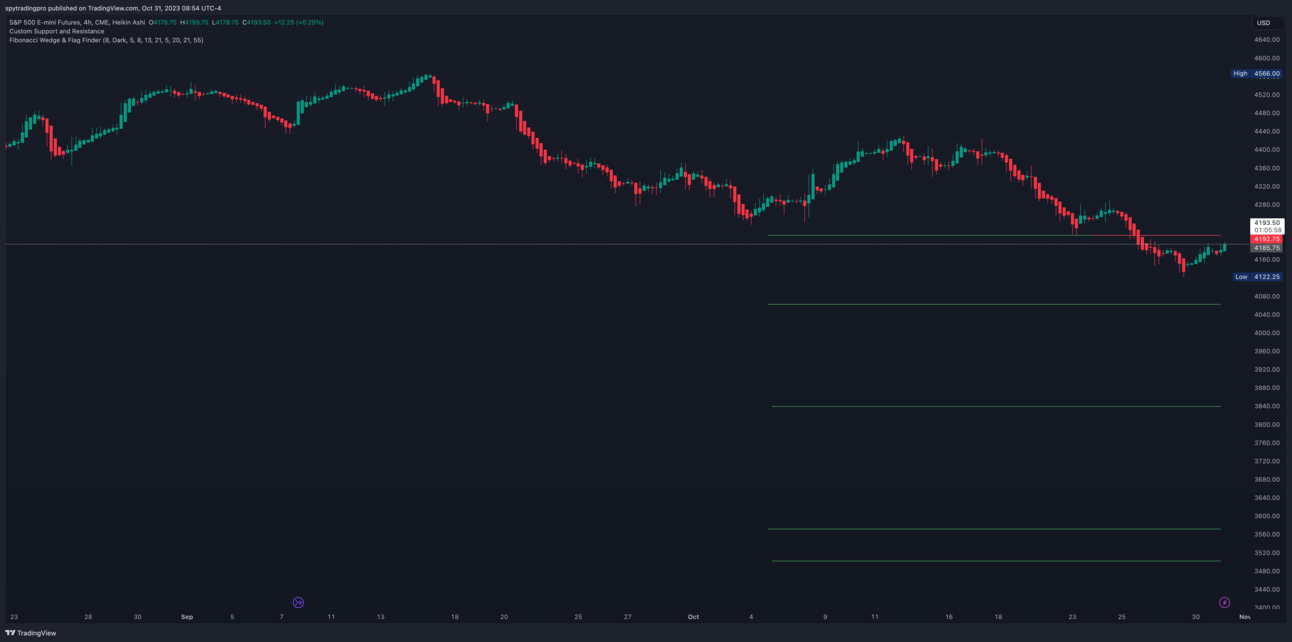

4-Hour

Key Structures

4247-50: This was the zone where it all began last Wednesday. We broke this down on Wednesday morning following 2 days of basing here. It is now a key backtest level.

4225-30: Big breakout level back in August.

4205: This area was an important support way back in May. We tested it 3x between May 10 and May 24th and it started a significant multi-month rally.

4147-53: This zone was an important level back in March, April and May. It was an important resistance in March, which then became support in May and set the ultimate May low.

Support Levels

4180-82 (major), 4171, 4162, 4147-53 (major), 4136, 4125 (major), 4112 (major), 4101, 4092 (major), 4075-80 (major), 4069, 4055-60 (major), 4043, 4037, 4025-30 (major).

Resistance Levels

4213 (major), 4225-30 (major), 4242, 4248-50 (major), 4258 (major), 4268, 4279, 4285 (major), 4297-4300 (major), 4314.

Trading Plan

Bull case today: ES did put in the framework for another attempted relief bounce, and generally, this is in play as long as we are above 4153-47, and sensible targets would be 4225-30, then 4247-50.

Bear case today: Begins on the failure of 4147-53. If 4153-47 fails, we must make a new low before another attempt.

Wrap Up

In summary, bulls are attempting another relief rally. These have nearly all failed for the past month, but in general, as long as 4147-53 keeps holding, the attempt is alive. If 4153-47 fails, we must make a new low before another attempt. As always, trade tactfully and avoid impulse entries.

Disclosure: This is not financial advice and is for informational purposes only. Please consult a professional financial advisor before making any investment decision.