Recap

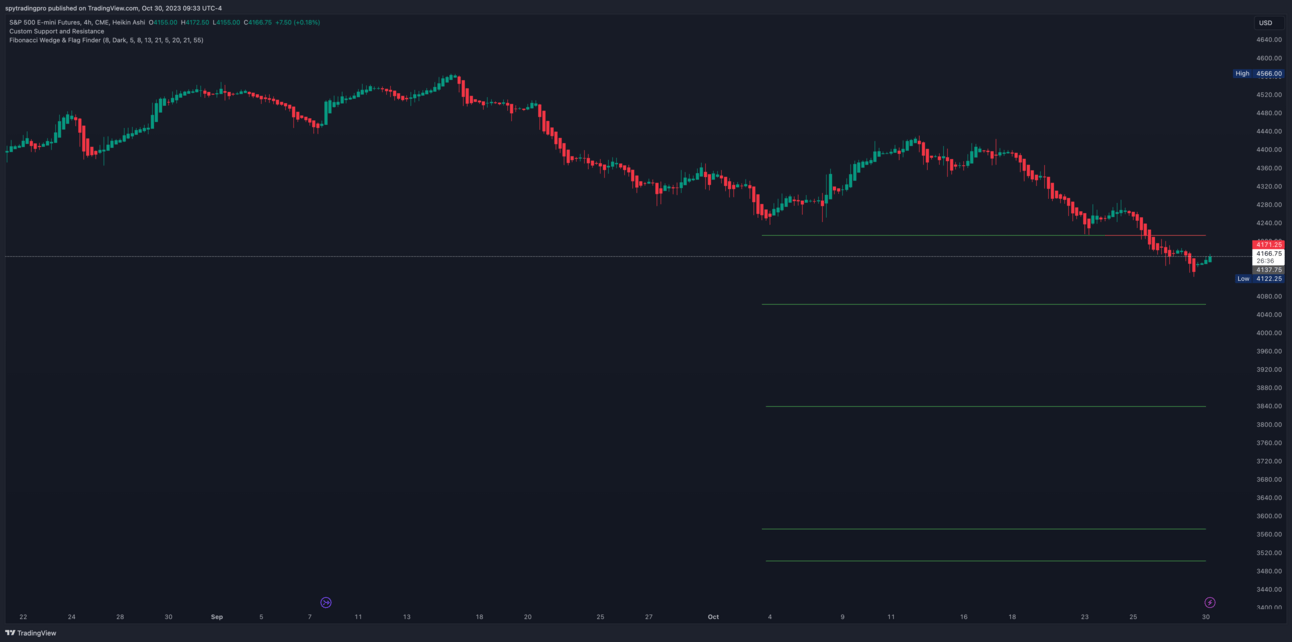

The week saw a continuation of the red streak in ES, with 8 of the last 9 days being red. The week was characterized by heavy selling, with ES losing its core bull market trendline from the 2020 COVID lows. Since then, ES has been in “sell the bounce” mode, with periods of basing interspersed by sharp sells lower for a total of 100 points down since the loss of this level on Wednesday.

The Markets Overnight

🌏 Asia: Up slightly

🌍 Europe: Up

🌎 US Index Futures: Up strongly

🛢 Crude Oil: Down

💵 Dollar: Down

🧐 Yields: Up

🔮 Crypto: Up a bit

Major Global Catalysts

Markets shrug off intensification of Israel’s ground offensive in Gaza.

Snapshot

Daily

4-Hour

Key Structures

- 4225: It was a big breakout level back in August.

- 4205: An important support way back in May. It failed on Wednesday after hours, backtested from below on Thursday, and we continued lower.

- 4153: An important level back in March, April and May. It was major support on Thursday, and acted as support yet again last Friday before flushing after 5 tests.

- 4120-26: The zone we ultimately broke out from in late March 2023, after nearly a full month of basing.

- 4075-80: A critical support zone.

- 4050-52: A major channel support.

Support Levels

4125 (major), 4117, 4112, 4102 (major), 4092 (major), 4076-80 (major), 4060, 4050-52 (major), 4045, 4025-30 (major), 4017, 4000-4005 (major).

Resistance Levels

4136, 4141, 4147-53 (major), 4163, 4171, 4181, 4187-90 (major), 4205 (major), 4213, 4218, 4225-30 (major), 4237, 4248-50 (major), 4255, 4264-68 (major), 4286, 4297-4300 (major), 4314-16 (major), 4323, 4335-40 (major), 4346, 4355, 4366-68 (major).

Trading Plan

The bull case started today with the reclaim of 4147-54. The bear case begins on the fail of 4125. The best shorts are on bounces, not on chasing red at the lows. If we test 4125 again put in another tradable bounce/failed breakdown (perhaps to 4117) then lose it after, I’d be looking short perhaps 4116 for the next leg down to 4102 then 4092.

Wrap Up

Although bears remain in control, downside is heavily stretched here, and RSI extremely oversold. As long as 4154 holds, we can work down to that 4101, 4092 zone before trying to hammer a low and reclaim 4154. Since 4154 reclaimed off the bat today, we start up direct. We could see a few large green days in the day ahead, but no promises.

Disclosure: This is not financial advice and is for informational purposes only. Please consult a professional financial advisor before making any investment decision.