Recap

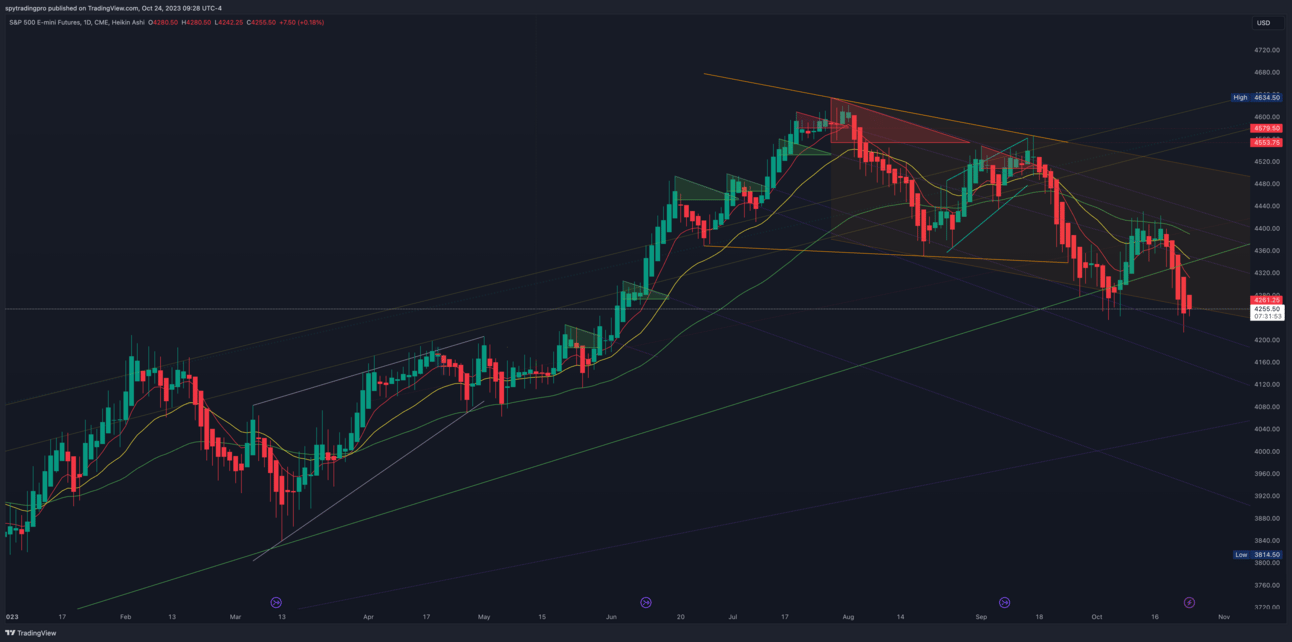

Last week, ES ended with a rare 4-day losing streak, pushing the RSI(5) into oversold territory. Despite a short squeeze yesterday, ES failed to close green, ending the day around the same spot as Friday. However, a bullish hammer candle was formed, indicating potential for a bullish follow-up today.

The Markets Overnight

🌏 Asia: Mixed

🌍 Europe: Mixed

🌎 US Index Futures: Up strongly

🛢 Crude Oil: Near unchanged

💵 Dollar: Up

🧐 Yields: Mixed

🔮 Crypto: Up strongly

Major Global Catalysts

Yields finally pullback

Snapshot

Daily

4-Hour

Key Structures

The breakdown of the core uptrend line from October 2022 through March 2023 was met with a short squeeze that occurred yesterday due to a failed breakdown and hitting multi-year support. As long as 4245 holds, we could see a return to 4272, and possibly 4297-4300.

Support Levels

4242-45, 4227, 4217-20, 4214, 4205, 4185-90, 4173, 4162, 4154, 4145, 4127-30, 4110, 4101, 4092-95, 4075, 4067, 4055, and 4047.

Resistance Levels

4258, 4268-72, 4279, 4287, 4297-4302, 4314, 4322, 4327, 4335, 4342, 4355, 4365, 4372-75, 4385, 4396, 4404, 4408, 4412, 4418, 4427, and 4439.

Trading Plan

The bull case for today would see the 4242 level hold, with any dips below going no lower than 4220 and spiking back up quickly. If this level holds, ES could aim for a green day, re-testing 4270 before heading up to 4297-4300 and 4335. The bear case starts with the failure of 4220-17, with a possible short at 4217 after a clear trendline/structure forms.

Wrap Up

Despite 5 red days in a row, the bulls have shown potential with a failed breakdown of last week's low, a daily hammer candle, and defending the trendline from the COVID lows. As long as 4245 holds, we could see a return to 4272, and possibly 4297-4300. However, failure of 4245 could lead to a retest of 4217-20 and a new leg down to 4185-90.

Disclosure: This is not financial advice and is for informational purposes only. Please consult a professional financial advisor before making any investment decision.